January 1st doesn't care if you're ready.

In less than two weeks, minimum wages increase across New York State. Exempt salary thresholds jump. Tip credits, meal credits, and uniform allowances all change. Your payroll formulas for overtime and blended rates need updating. And if you're a New York City employer, you've got even more coming in February—including a brand new 32-hour unpaid leave requirement that most employers don't even know exists yet.

Plus, there's a new state-mandated retirement program with registration deadlines starting in March 2026.

Miss these deadlines and you're not just non-compliant, you're writing checks to the Department of Labor and handing ammunition to plaintiff's attorneys. For hospitality employers running on thin margins, a single tip credit mistake can spiral into a six-figure class action before you've poured your first cup of coffee.

This article breaks down every change hitting New York employers in 2026: whether you're running an office, a restaurant, a hotel, or a retail operation. You'll get the exact numbers, the formulas for overtime calculations, and a compliance checklist you can implement today.

January 1, 2026: The Big Reset

Every year, January 1st brings wage increases. This year marks the final scheduled increase before New York switches to inflation-indexed adjustments in 2027—meaning after this year, you won't know the new rates until October of the preceding year.

Minimum Wage & Overtime Rates

⚡ Compliance Tip ⚡

You must issue updated Notice of Pay Rate forms to ALL employees affected by wage changes—not just new hires. The Wage Theft Prevention Act penalty of $50/day per employee hasn't gone anywhere, and it adds up fast.

Exempt Salary Thresholds

To classify an employee as exempt from overtime under the executive or administrative exemptions, they must meet BOTH the duties test AND the salary threshold:

🚨 ALERT 🚨

The federal salary threshold is still $684/week ($35,568/year) after the Biden DOL overtime rule was struck down in November 2024. But that doesn't help New York employers—you MUST meet New York's higher threshold. The only exception is the professional exemption, which remains at the federal floor since New York has no separate professional threshold. Remember: salary alone doesn't make someone exempt. They must also pass the duties test.

Hospitality Industry: Tip Credits, Meal Credits & More

If you operate a restaurant, hotel, or any hospitality business, the NY Hospitality Wage Order creates additional requirements. These rates change every time minimum wage increases.

Food Service Worker Rates

Food service workers—servers, bussers, bartenders—who regularly receive tips and satisfy the 80/20 rule:

Service Employee Rates

Service employees—bellhops, valets, spa attendants, coat check, bathroom attendants—who receive tips but aren't food service workers:

How Overtime Works for Tipped Employees

This is where many employers get tripped up. For tipped employees, overtime is calculated on the full minimum wage rate—then the tip credit is deducted. You cannot simply multiply the cash wage by 1.5.

The Formula:

Step 1: Calculate overtime on full minimum wage: $17.00 × 1.5 = $25.50

Step 2: Subtract the tip credit: $25.50 − $5.65 = $19.85

Result: Food service worker OT cash wage = $19.85/hour (NYC/LI/Westchester)

🔎 Audit Red Flag 🔎

The tip credit ONLY applies if the employee actually receives enough tips to reach minimum wage each week. If a server has a slow week, you must make up the difference. Track this weekly—not just at the end of the pay period.

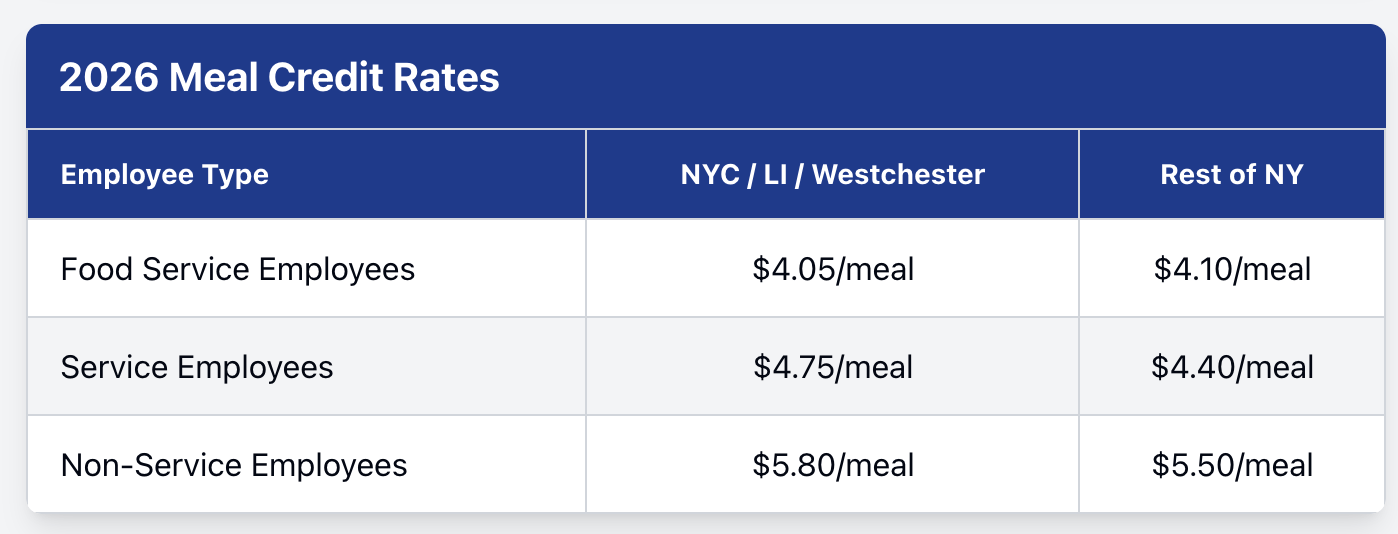

Meal Credit Rates (By Employee Type)

If you provide meals to employees, you can credit up to these amounts against wages—but ONLY if the meal meets strict requirements:

Required Meal Components (All Four Required):

Fruits OR vegetables; AND

Grains OR potatoes; AND

Eggs, meat, fish, poultry, dairy, OR legumes; AND

Tea, coffee, milk, OR juice.

🚩 Common Pitfall 🚩

A roll and coffee does NOT qualify. Neither does pizza alone. The meal must include at least one item from ALL FOUR food groups. Employers must keep records of the meals provided and their actual cost. You may also need to provide halal, kosher, or other accommodating options depending on employee requests.

Uniform Maintenance Pay (By Hours Worked)

If employees must wear uniforms and you don't launder them, you owe weekly uniform maintenance pay based on hours worked:

📝 Pro Tip 📝

Uniform maintenance pay lawsuits are on the rise. Your options are: (1) launder the uniforms yourself, (2) use "wash and wear" materials that meet regulatory requirements, or (3) pay the allowance. If you want to use the wash and wear exception, consult legal counsel to ensure you meet the specific requirements.

Update Your Payroll System—Not Just Your Forms

Issuing new Notice of Pay Rate forms is only half the battle. Your payroll system needs to be updated to ensure every calculation is correct:

Base wage rates must reflect 2026 minimums

Overtime formulas must calculate on the correct base (1.5× minimum wage, then deduct credits)

Blended overtime rates for employees working multiple positions must use 2026 rates

Tip credit deductions must use new amounts

Meal credit deductions must use new amounts by employee type

Uniform maintenance pay must be calculated based on hours worked that week

Pay Stub Requirements

New York pay stubs must include:

Hours worked (regular and overtime separately)

Rate of pay and basis (hourly, salary, etc.)

Gross and net wages

Deductions

Paid safe/sick leave balance AND usage

Unpaid safe/sick leave balance AND usage (NYC, starting Feb 22, 2026)

Prenatal leave usage and remaining balance (if applicable)

⚡ Compliance Tip ⚡

If you maintain a written tip pool or tip sharing agreement, it must be revised to reflect the new minimum wage, cash wage, and tip credit amounts. Same goes for any employee handbook that references these rates.

February 22, 2026: NYC's ESSTA Expansion

New York City amended its Earned Safe and Sick Time Act to add 32 hours of UNPAID safe and sick time—separate from existing paid leave. This also consolidates the Temporary Schedule Change Act into ESSTA.

What You Must Do

Create a separate 32-hour unpaid leave bank – completely separate from paid ESSTA

Frontload upon hire – employees get all 32 hours immediately

Refresh on January 1 each year – unused hours do NOT carry over

Track BOTH balances on pay stubs – paid AND unpaid leave must appear

Default to paid leave – unless employee specifically requests unpaid

Update your ESSTA policy – must now include prenatal leave policy as well

Post updated Notice of Employee Rights – in English plus any language spoken by 5%+ of workforce

📝 Pro Tip 📝

NYC employers must also include prenatal leave in their ESSTA policy. Your policy must state that you won't require medical details about the condition and will keep any information confidential. Prenatal leave (20 hours paid per 52-week period) usage and remaining balance must appear on every pay stub where it's used.

COVID-19 Paid Sick Leave: It's Gone

On July 31, 2025, New York removed its requirement that employers provide paid COVID Leave. If you still have a COVID-19-specific leave policy in your handbook, remove it.

Employees who contract COVID-19 can still use regular ESSTA leave. And you're still required to comply with the NY HERO Act, which requires maintaining plans to protect employees against future airborne disease outbreaks.

NEW: NY Secure Choice Savings Program

After years of delays, New York's state-mandated retirement savings program is finally live. If you don't offer a qualified retirement plan (401(k), 403(b), SEP, SIMPLE, or 457(b)), you may be required to register and facilitate automatic payroll deductions into Roth IRAs for your employees.

Who's Covered

Private employers must participate if they:

Have 10 or more employees in New York

Have been in business at least 2 years

Do NOT currently offer a qualified retirement plan

2026 Registration Deadlines

March 18, 2026: Employers with 30 or more employees

Later in 2026: Employers with 10-29 employees (exact date TBD)

If you already offer a retirement plan, you must still log in to the Secure Choice portal and certify your exemption.

⚡ Compliance Tip ⚡

Default employee contributions are 3% of pay. Employees can opt out at any time, but if they don't, you must deduct and remit contributions. No employer contributions are required. Visit newyorksecurechoice.com for registration.

Case Study: Getting It Wrong

The Setup: A Manhattan restaurant with 45 employees failed to update their tip credit rates on January 1, 2025. They continued paying servers the 2024 cash wage for three weeks.

The Payroll Mistake: Their payroll system was still calculating overtime using the old formula. When a server worked 50 hours, she was underpaid by $3.50 per overtime hour—plus the tip credit underpayment.

The Trigger: A departing server filed a wage complaint. DOL didn't just look at her file—they audited the entire operation.

🔎 Audit Red Flag 🔎

DOL investigators know January is when employers mess up wage rate updates. They specifically target complaints filed in Q1. Don't be the business still running 2025 rates on January 2nd.

Case Study: Getting It Right

The Setup: A hotel group with properties in Manhattan, Long Island, and Westchester began their 2026 compliance prep in early November.

The Process: By December 15th, they had:

Updated all payroll rates AND formulas in their system

Verified overtime calculations used 1.5× base rate before deducting credits

Prepared Notice of Pay Rate forms for every hourly and tipped employee

Updated tip pool agreements with new rates

Added 32-hour unpaid ESSTA bank for NYC locations

Updated pay stubs to show both leave balances

Certified their exemption from Secure Choice (they offer a 401(k))

The Result: Zero compliance issues. When a former bellhop filed a wage complaint in February, complete documentation showed proper rates from Day 1. Complaint dismissed.

🎯 Best Practice Highlight 🎯

Start compliance prep at least 6 weeks before any deadline. For employers with tip credit complexities, that extra time is the difference between smooth operations and DOL investigators at your door.

Action Steps: The READY Framework

Use this framework to get compliant before the ball drops:

R – Rates & Formulas Update all minimum wage, tip credit, meal credit, uniform rates AND overtime calculation formulas

E – Exempt Review Verify every exempt employee meets the 2026 salary threshold

A – Acknowledge Prepare and distribute Notice of Pay Rate forms; update tip pool agreements

D – Documentation Systems Update pay stubs to show leave balances; verify meal records are being kept

Y – Your Handbook & Leave Policies Remove COVID leave, add prenatal leave, update ESSTA (add 32-hour unpaid bank for NYC)

⏰ Reminder ⏰

If you have 30+ employees and don't offer a retirement plan, register for NY Secure Choice by March 18, 2026. If you DO offer a plan, certify your exemption. Visit newyorksecurechoice.com.

Final Thoughts: Start Now, Not January 2nd

Employment law compliance isn't about checking boxes—it's about protecting your business and treating your employees fairly.

The employers who get in trouble aren't usually trying to cut corners. They're the ones who meant to update their policies, planned to issue new wage notices, and figured they'd get to the payroll formulas eventually.

"Eventually" doesn't work when January 1st is less than a month away.

Use the READY framework. Download the checklist. Block the time. Update your systems—not just your paperwork.

Your future self—and your legal budget—will thank you.

Keep fighting the good fight.

Legal Disclaimer: This article provides general information about New York employment law and is not legal advice. Every situation is unique. For specific guidance on your circumstances, consult with an employment attorney licensed in your jurisdiction.